Cost of Goods Sold (COGS) for Amazon with Google Sheet

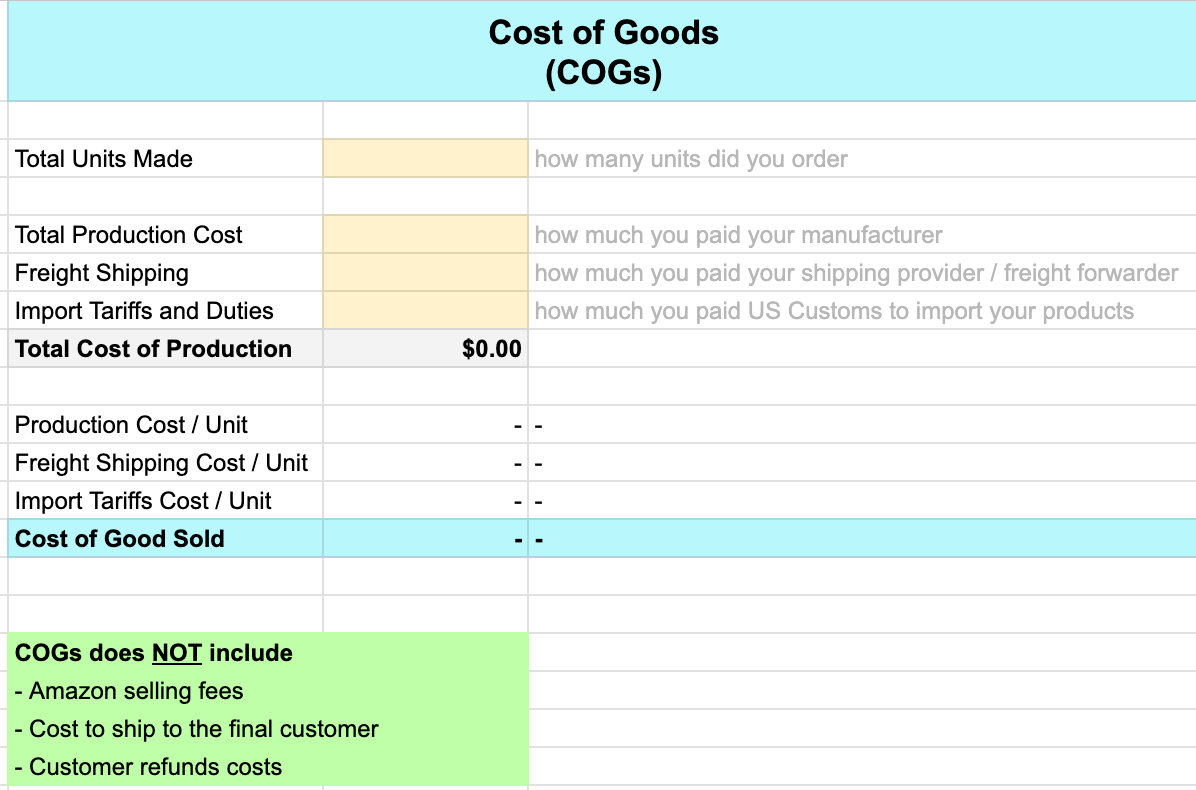

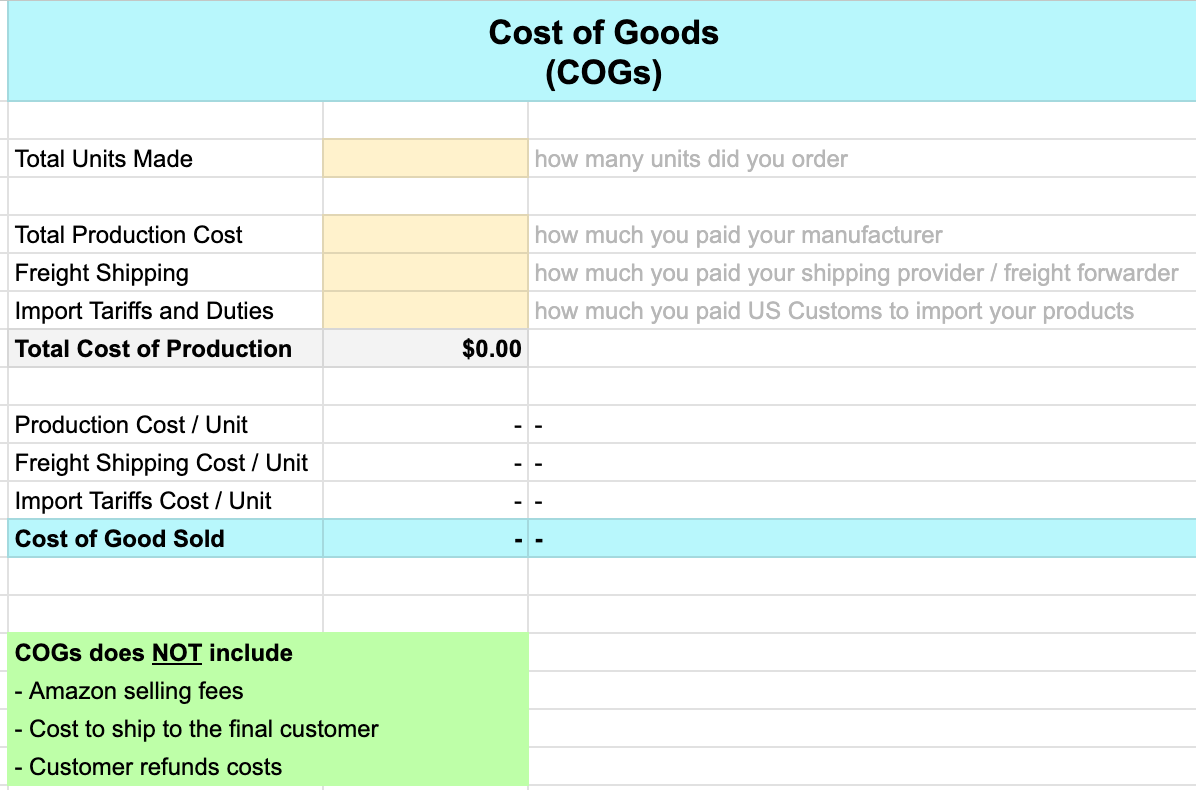

A simple way to calculate your Cost of Goods Sold (COGS) for Amazon. Download my free COGS calculator Google Sheet.

This is a quick post to help you calculate your cost of goods sold (COGS). No fluff—just the essentials. Let’s break it down! 👇

Why This Post? 🤔

Someone reached out recently and made me realize that my previous videos and posts on bookkeeping were packed with info—maybe too packed.

So, I decided to create these bite-sized posts to cover one concept at a time. Each one will bring you one step closer to fully understanding bookkeeping, advertising costs, external traffic, affiliate marketing, and more.

What is Cost of Goods Sold? 💰

COGS is the total cost you incur before your product reaches the final customer. In other words, it’s everything you spend to produce and prepare your product for sale.

Breaking it down, there are three main components:

1️⃣ Cost of Production

2️⃣ Shipping Costs

3️⃣ Taxes & Import Fees

Let’s go deeper into each! 🔍

If you want to follow along and calculate your COGS you can download the COGS Calculator here.

1️⃣ Cost of Production 🏭

This includes everything your manufacturer charges to make your product. It also covers packaging, inserts, and anything else that comes in the box.

For me, this is straightforward—I pay my supplier a single amount, and they handle production, packaging, and inserts.

When my Eggboards leave the factory, they’re fully prepped and ready to ship. 🏄♂️

2️⃣ Shipping Costs 🚢

No matter where you manufacture, you’ll need to move your products to a location where they can be delivered to customers.

For me, this means:

- Freight shipping from China to the U.S.

- Transportation from the port in Los Angeles to Amazon’s FBA warehouse

If your logistics involve third-party warehouses (3PLs), make sure to track the cost of getting products from the manufacturer to the 3PL, and then from the 3PL to the final delivery facility (like an FBA warehouse).

3️⃣ Taxes & Import Tariffs 📦

If you import your products into the U.S., you’ll need to pay customs duties. This cost must be included in your COGS because it’s a necessary expense to get your product ready for sale.

If you manufacture domestically, you might not have this cost, but it’s worth mentioning since many businesses source products (or part of them) from overseas. 🌎

Costs That Do Not Contribute to COGS ❌

Some expenses are related to selling your product but are not part of your cost of goods sold. These include:

1️⃣ Amazon FBA Fees – This is the cost Amazon charges to store and deliver your product to customers once they place an order.

2️⃣ Amazon Selling Fees – Amazon takes a percentage of each sale, usually around 15%, as a selling fee.

3️⃣ Cost of Returns – Especially on Amazon, customers can easily return products, and if the returned item is damaged or unsellable, you bear the cost.

None of the costs above are included in COGS because they are associated with selling the product, not making it ready for sale.

What’s Next? 📝

Now that you know how to break down COGS, input your total costs into a this simple Google Sheet to keep track of everything.

👉 Sign Up to Download the COGS Calculator