How I do Amazon Cost of Goods Accounting on Quickbooks

In this post, I’ll show you exactly how to calculate Cost of Goods (COGs) from Amazon and import it into QuickBooks.

Part 1 - Ultimate Quickbooks Template for Amazon Bookkeeping

Part 3 - Simple Profit & Loss Sheet to track Amazon Profits

This is the second post in a 3-part series about my QuickBooks Template for Amazon 📊. If you haven’t yet, make sure to check out the first post on how to import Amazon Payment reports into QuickBooks.

For a simple walkthrough of what is Cost of Goods, what goes in it, and what not check my post: Cost of Goods Sold (COGS) for Amazon with Google Sheet

As always, you can download the spreadsheet I use for free from the link at the bottom of this page!

In this post, I’ll show you exactly how to calculate Cost of Goods (COGs) from Amazon and import it into QuickBooks.

👉 Sign Up to Download the QuickBooks Template for Cost of Goods

How to Know Your Cost of Goods

It usually includes:

✅ Manufacturing costs

✅ Packaging costs

✅ International shipping (if you manufacture overseas like I do)

✅ Import taxes & customs duties

I track all these expenses from the moment I start a new production. This allows me to know exactly how much each product costs—which is 🔑 key to understanding my Profit & Loss.

Why Cost of Goods is Key

Because it directly affects your profit margin. 💰

Your COGs determine pricing decisions and impact your bottom line. Different products have different costs, and you need to know exactly how much each one costs to make informed decisions.

For example:

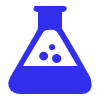

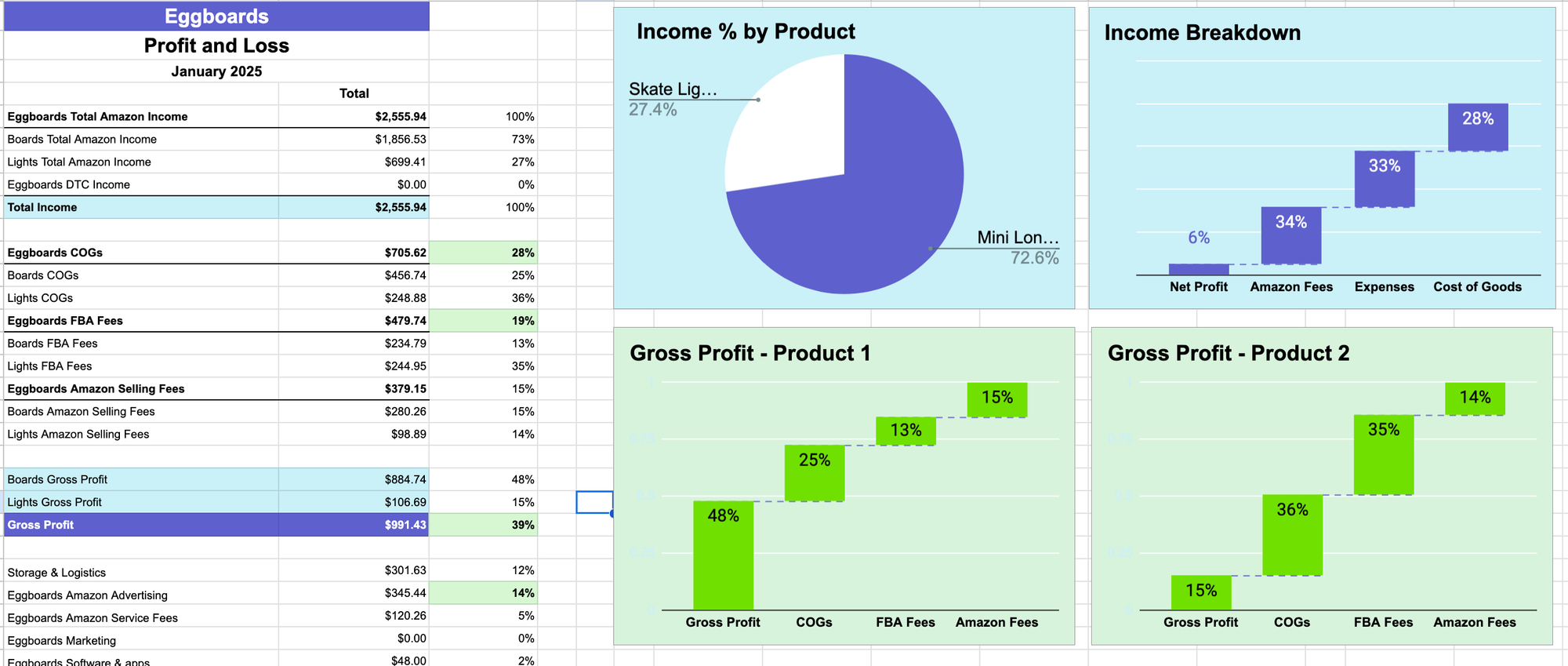

📆 January 2025 Profit & Loss Report (Eggboards)

- COGs for my skateboards: 25%

- COGs for my skate lights: 36% ⚠️

Big difference! This tells me I need to increase my skate light prices to improve my gross margin, because the high COGs are eating into my profits.

Setting Up Your QuickBooks COGs Template

I built a simple Google Sheet to track COGs.

👉 Sign Up to Download the QuickBooks Template for COst of Goods

✅ Set it up once, update monthly

✅ Easy to outsource (my VA does it for me!)

How to set it up:

1️⃣ Add your SKUs and their Cost of Goods. I sell 3 skateboard variants + 2 skate light variants.

2️⃣ Add the entry corresponding to Quickbooks for your current inventory value and cost of goods expenses.

The first one goes into your Balance Sheet to track inventory valuation. The second goes into your Profit and Loss statement and determines your Gross Profit.

If this sounds complicated, grab my free QuickBooks Chart of Accounts, customize it with your product names, and upload it into your QuickBooks. 🔥

If you get stuck, drop a comment—I’ll help you out!

Let’s Import Your COGs Into QuickBooks

Now, we’ll download data from Amazon into this spreadsheet 📥 and then import it into QuickBooks.

What this spreadsheet does:

✔️ Counts how many units of each SKU you sold last month

✔️ Calculates the total Cost of Goods for those units

✔️ Accounts for that value as Cost of Goods Sold (COGS) in your Profit & Loss

✔️ Deducts that value from your total inventory (since you no longer own those products)

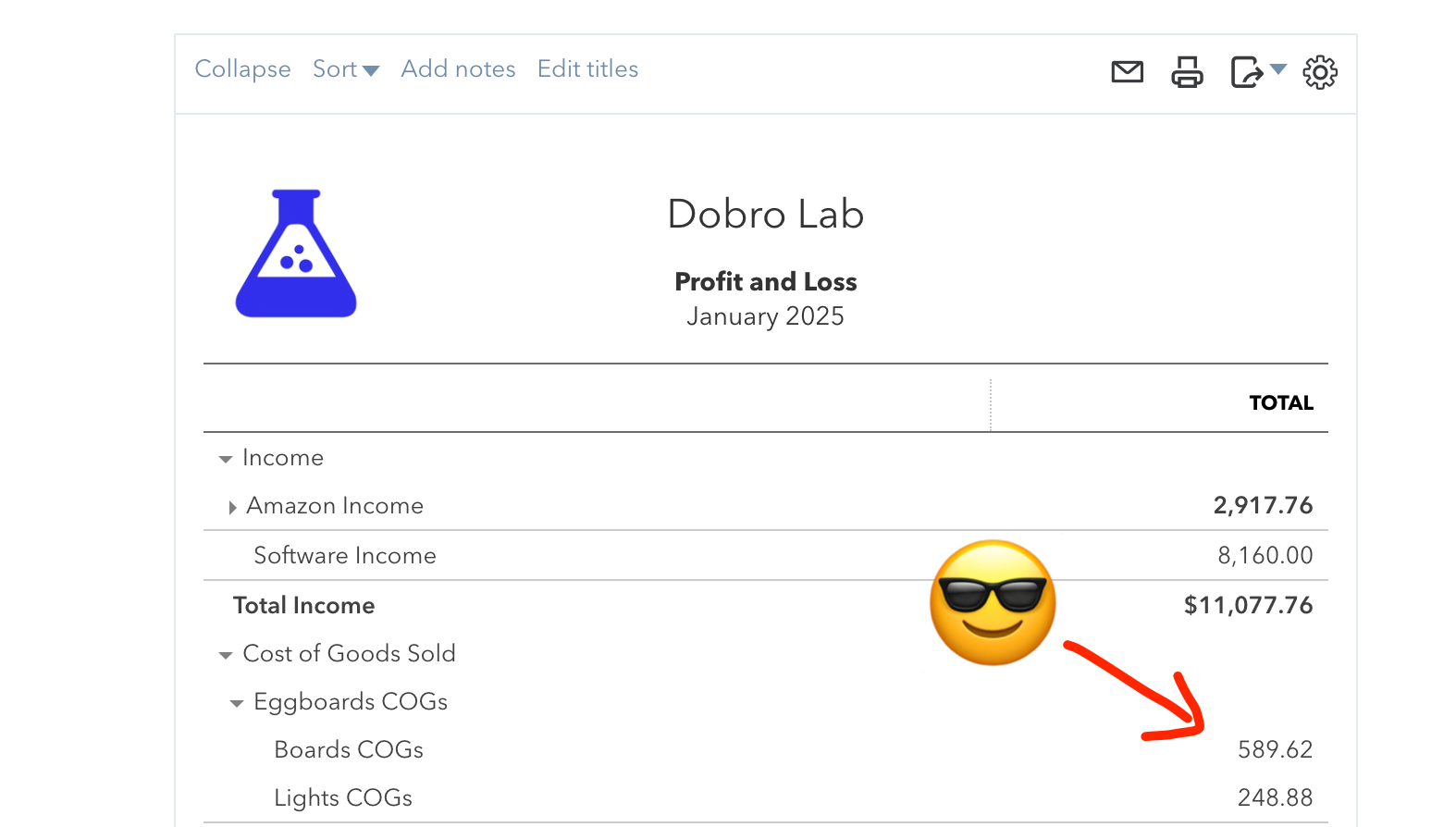

📌 Now check your QuickBooks P&L—your COGs are there! 🎉

✍ Recap

This was post #2 in my 3-part series on Amazon-to-QuickBooks bookkeeping.

Today, we covered:

✅ What Cost of Goods is & how it’s calculated

✅ Why tracking COGs for each product is key to profitability

✅ How to set up a simple Google Sheet for COGs

✅ How to import COGs data from Amazon into QuickBooks

Now your Profit & Loss report is complete and ready for your accountant. But let’s be honest—QuickBooks reports aren’t the easiest to read. 👀

That’s why in the next post, I’ll show you how to take your QuickBooks P&L and turn it into an easy-to-read, actionable template to monitor your profits every month.

If you haven’t yet, check out my first post on how to import Amazon Payment reports into QuickBooks! 🚀

👉 Sign Up to Download the QuickBooks Template for Cost of Goods

Questions?

Drop a comment below... let's chat!