China Tariffs 2025 – What’s the Cost for Amazon Sellers?

Chinese tariffs for 2025 are here. Download a free Google Sheet to assess their real impact on your Amazon profits.

There has been a lot of talking on the media about the new China Tariffs.

I just brought in my latest shipment of skateboards for Eggboards. When I compared my import fees from December 2024 vs. March 2025, I was shocked at first, then I realized what happened.

The new China Tariffs came into effect on March 4th 2025.

So, what’s the real impact? Am I still profitable? Do I need to raise prices?

To find out, I made a simple spreadsheet to calculate the exact cost of these new tariffs. You can download it for free below! ⬇️

What Changed in March 2025?

Since early March, new import tariffs have been in place. They affect all goods coming from:

✅ China

✅ Hong Kong

✅ Canada

✅ Mexico

For my business, this is a big deal.

I manufacture in China, working with my supplier Ray. We’ve been working together for seven years.

He’s a great guy. A bit wild. I’ll make a video about him one day. 🤣

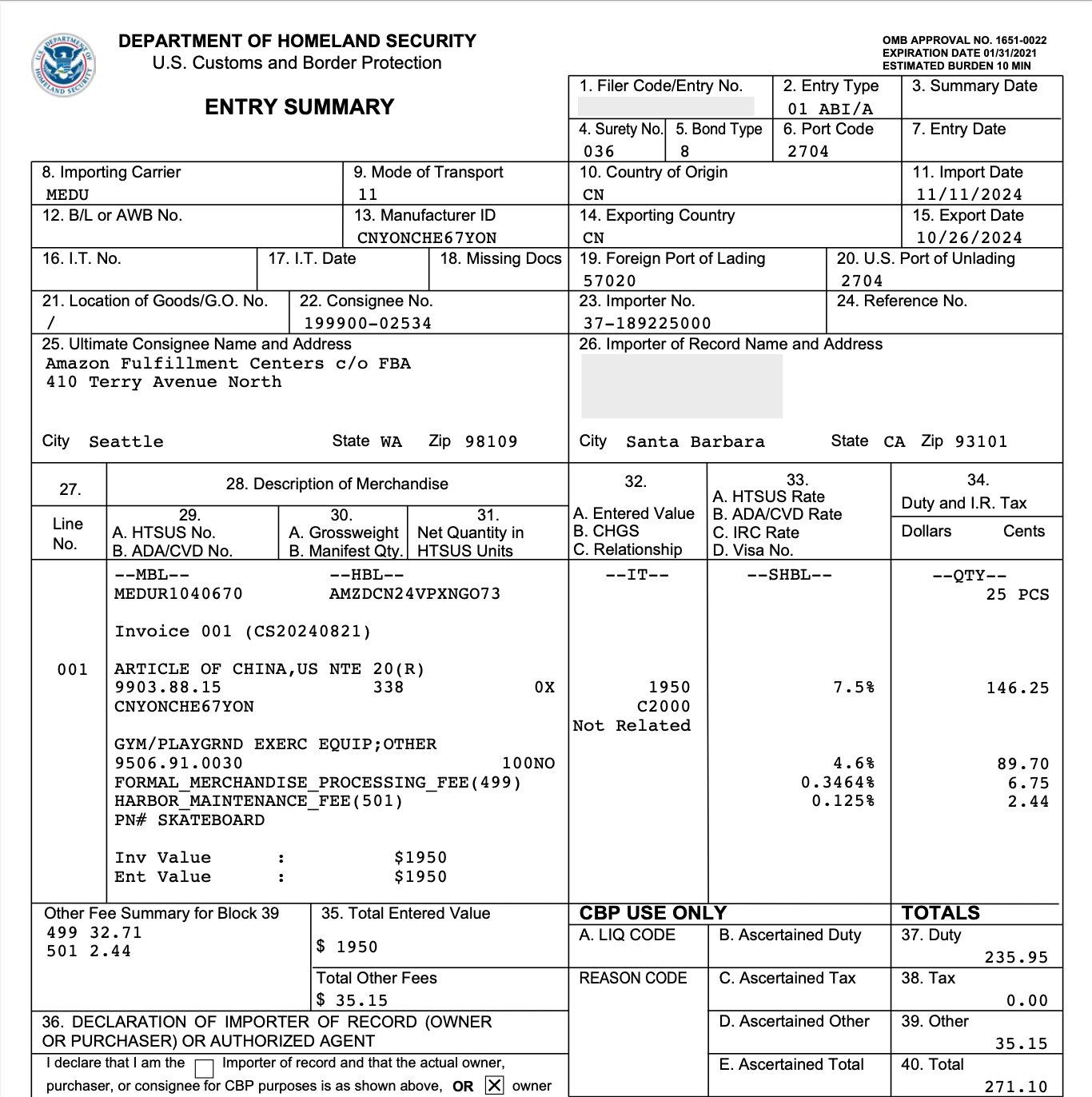

Every 2-3 months, I import new batches of 100 skateboards. When my products arrive in the US, I receive a Customs Entry Summary—a one-page document listing all the fees I pay to U.S. Customs.

It looks like this:

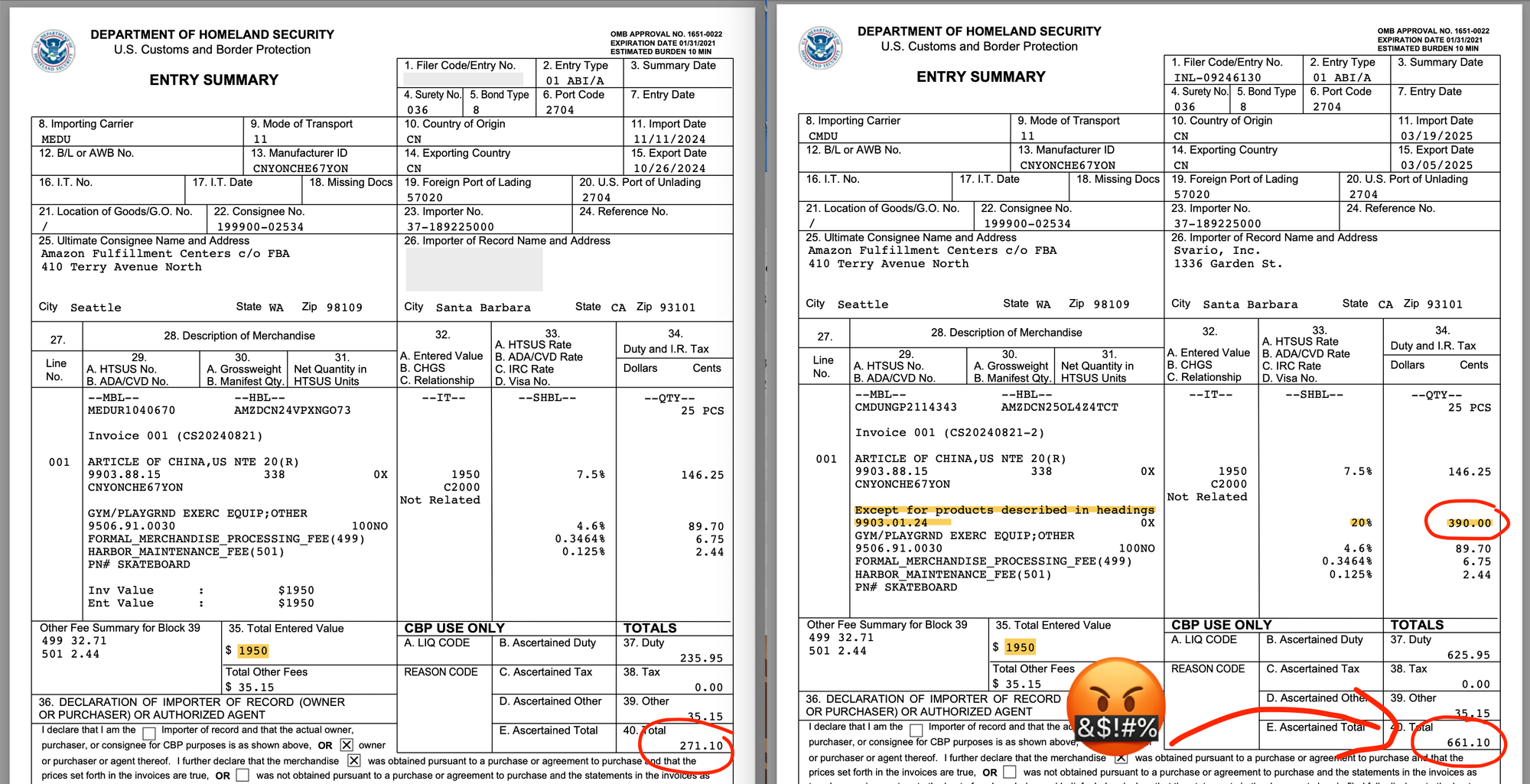

I compared my December 2024 shipment with my March 2025 shipment. And there it was. A brand-new fee:

💸 An extra $390 in tariffs for a shipment worth less than $2,000.

That’s painful. But how bad is it really? Let’s break it down.

The True Cost of These New Tariffs 📊

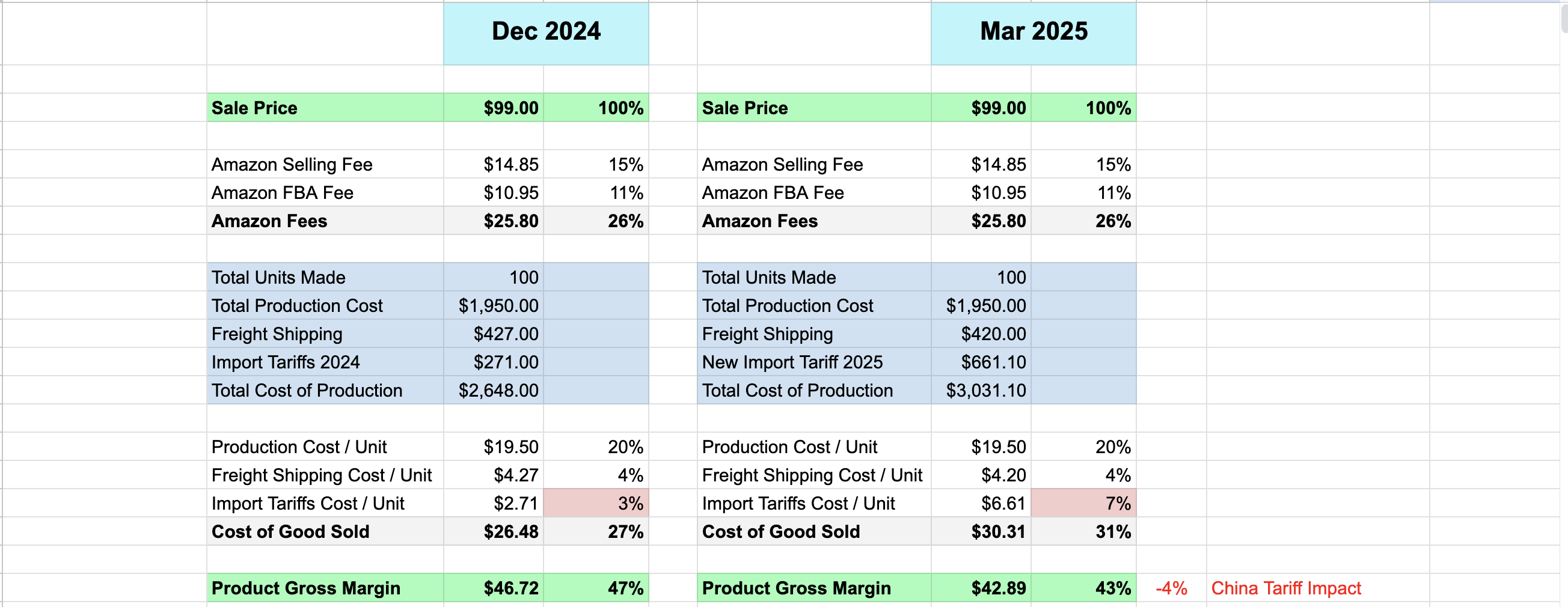

Here’s a side-by-side comparison of my import costs in December vs. March:

🚢 December 2024 Import Tariffs: $271

🚢 March 2025 Import Tariffs: $661

That’s 2.5x higher than before. A 20% tariff increase added hundreds of dollars to my costs.

But what does that actually mean for my profit margins? 🤔

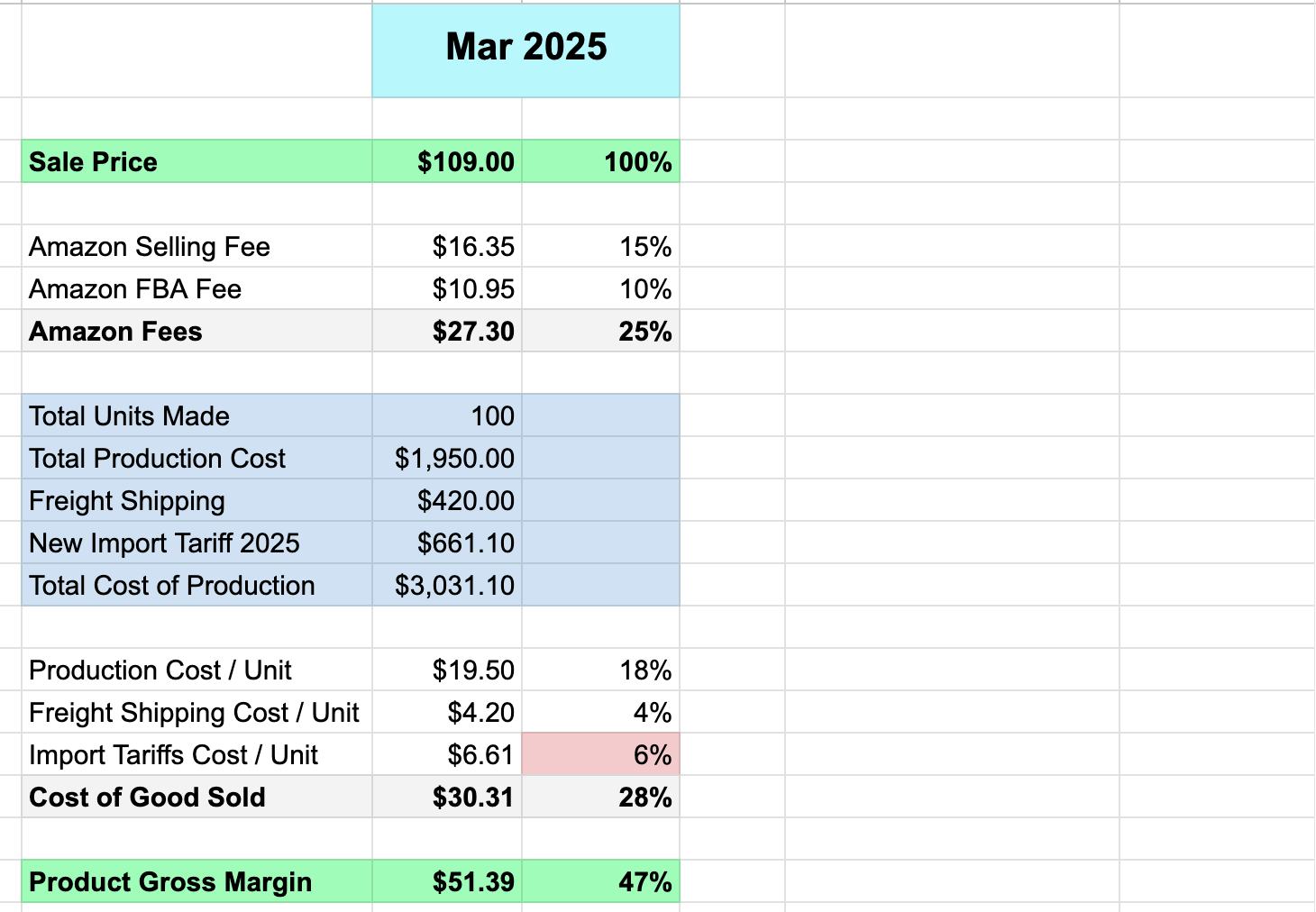

To find out, I plugged everything into my spreadsheet. Here’s what it looks like

December 2024 Costs (Before Tariff Increase)

✅ Selling Price (on Amazon): $99

✅ Amazon Selling Fee (15%): $14.85

✅ Amazon FBA Fee: $10.95 (~11%)

✅ Production Cost (for 100 units): $1,950

✅ Shipping Cost (from China): $420

✅ Import Tariffs: $271

🔹 Gross margin: 47%

March 2025 Costs (After New Tariffs)

✅ Selling Price (still $99)

✅ Amazon Selling Fee (15%): $14.85

✅ Amazon FBA Fee: $10.95 (~11%)

✅ Production Cost: $1,950

✅ Shipping Cost: $420

✅ Import Tariffs: $661 (⬆️ from $271)

🔹 Gross margin: 43%

The new tariffs ate 4% of my profits.

Most Amazon Sellers I've met operate at a final Net Profit between 10-20%. And I do too.

So -4% won't get me out of business... but it definitely stings 🐝

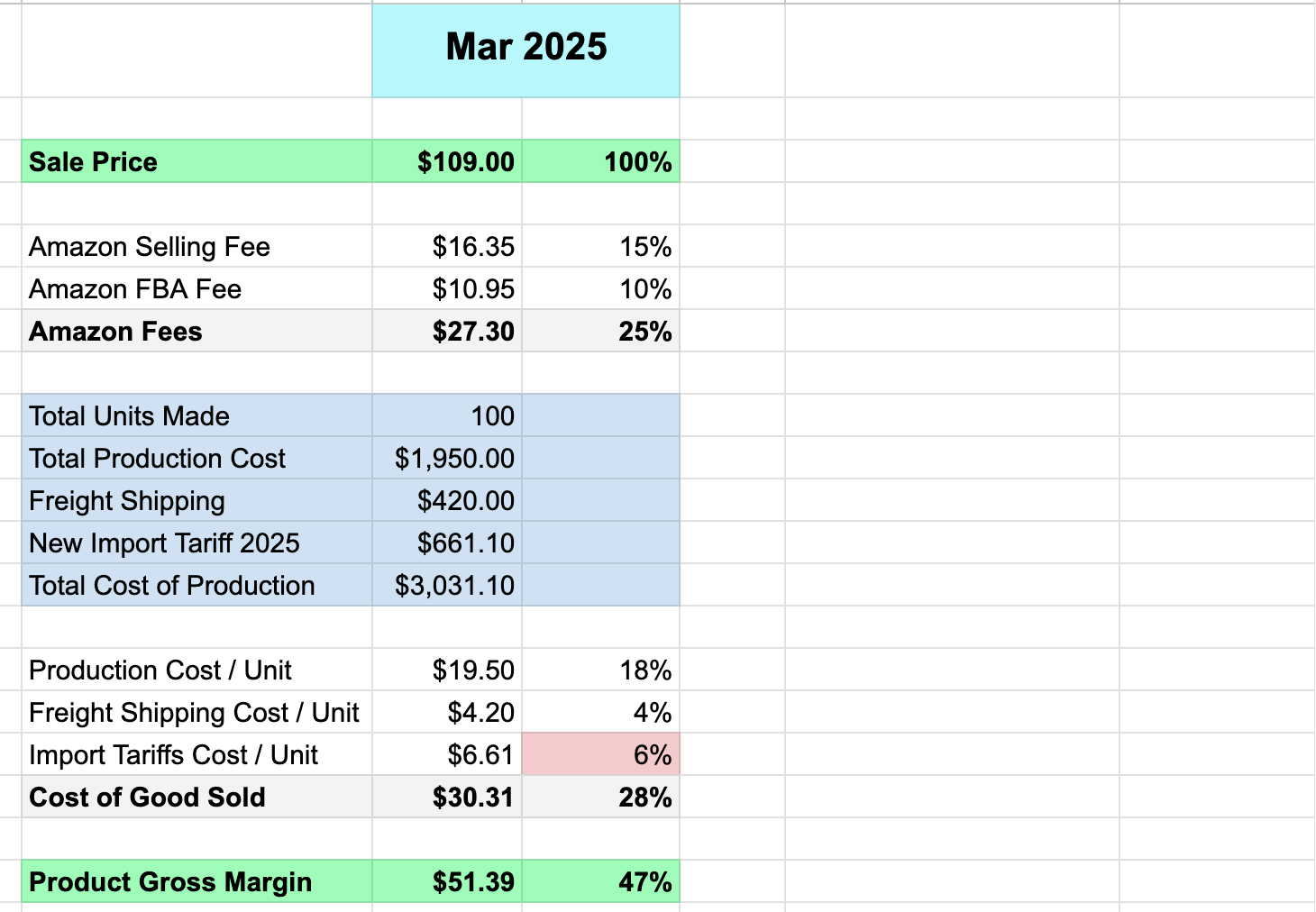

Should I Raise My Prices? 🤔

If I want to keep my original 47% margin, I’d need to increase my price from $99 → $109.

That’s a $10 price jump just to stay at the same level of profitability. Not great. But necessary? Maybe.

Here’s what this means for you:

✅ The real impact of a 20% tariff increase isn’t 20% of revenue. In my case, it’s 4% of profits. That’s why it’s so important to break it down and see the true cost.

✅ Numbers matter more than headlines. There’s a lot of panic about these tariffs, but most people don’t actually calculate the effect on their business. They just assume it’s the end of the world. It’s not. But it does require a strategy.

✅ You need to make a decision. Do you absorb the cost and accept lower profits? Or do you raise prices and risk losing some customers?

How to Figure This Out for Your Own Business 🚀

I built a simple spreadsheet to calculate exactly how much these new tariffs affect my profits. You can download it for free below!

Just enter your:

✅ Selling price

✅ Amazon FBA fees

✅ Cost of production

✅ Shipping costs

✅ Tariff percentage

And you’ll see how much of your profits are disappearing. It’s an easy way to make informed decisions instead of guessing.

Final Thoughts

Yeah, these new tariffs suck. I won’t pretend they don’t.

But the key takeaway is this: they aren’t the end of the world.

A 20% increase in tariffs doesn’t mean your business is dead.

It means you need to understand the numbers and make a choice. Raise prices? Accept lower margins? Find another way to cut costs?

That’s the game. And this spreadsheet helps you play it smarter.

👉 Sign Up to Download the Product Profitability Calculator

Hope this breakdown helps! Let me know in the comments what you’re seeing with your own imports. 🚀